Summary

At its core, Facebook is a 21st century iteration of a modern communications platform. Communications platforms need to perform a few simple functions – efficiently address the endpoints and provide a channel for communication of reasonable fidelity. Some improvements made over the 20th century include multi-party communications, address books and increasing fidelity (text, voice, photos, video and a combination of the four) on the channel. Facebook initially innovated in the following areas:

- It took the address book component of a communications platform and extended it significantly; allowing a digital representation of the endpoint to exist (i.e. not only an address, but a profile – photo, interests, birthdays, etc.).

- It also makes the basic assumption that all your endpoints are part of a virtual broadcast network or even more aggressively, that they are all connected to each other through you.

- As a corollary, it also broke the basic assumption of private communications, making most communications explicitly public unless otherwise indicated.

Facebook used these basic innovations to create a unique and proprietary communications network which it used to build network effect. Facebook then made a few further strategic decisions:

- Keep the network closed

- Increase the value of the network beyond its base communications value proposition by providing tools for all manner of life conversations inside the network (notes, photos, links, etc.)

- Built an application platform for third parties to offer services to the network which then serves as a distribution platform.

To recap, Facebook created value by (a) Creating a unique and proprietary incarnation of a communications network (b) Increasing the value in the network by encouraging different kinds of conversations (and storing them) (c) Offering the network as a distribution platform for third parties.

Value chain

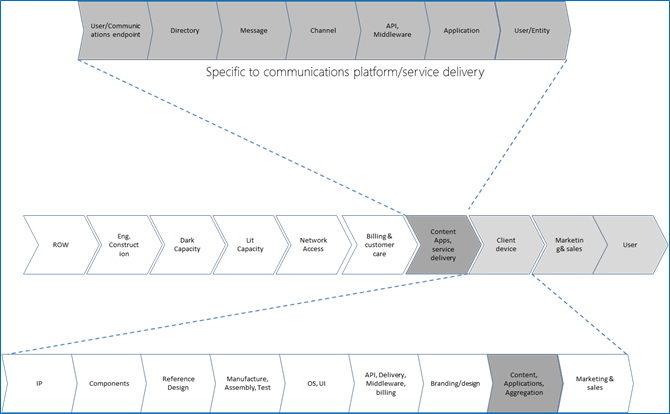

Communications platform and application value chain

Endpoint –Directory – Message – Channel –APIs, middleware, etc. – Communication Application – User

Social networking/Telecomm value chain

See above.

Integration strategy

Facebook has vertically integrated almost all the functions of a communications platform aspect of service delivery into itself. For example you start a message on Facebook and it’s delivered on Facebook. The message never leaves the network. Additionally you cannot receive it on any other platform or application unlike email. No device can be made that interoperates with its network without the sanction of Facebook.

When you come up one level to the telecoms value chain, Facebook is horizontally integrated, providing applications on many devices and APIs that allow messages to be delivered to and from its communication platform.

Additionally Facebook offers the network as a distribution endpoint for application (Zynga) and content companies (Warner Bros.) and it controls the mechanism of this distribution through its APIs. This provides positive network externalities – Facebook applications and content create even more opportunities for a customer’s life conversations to be hosted on Facebook which helps them derive more overall value.

By creating a communications platform with strong network effects (both cross side and same side) with positive network externalities, Facebook has created a very compelling platform with significant barriers to entry.

Analogy

Facebook is the Microsoft of the online content and application universe. Consider: it has massive scale on a compelling platform, to which it controls access to, through APIs and content deals. In fact it is less open than Microsoft ever was. See below:

| Microsoft | ||

| Demand side user | Open | Open |

| Supply side user (app developer) | Open | Closed |

| Platform provider | Open | Closed |

| Platform sponsor | Closed | Closed |

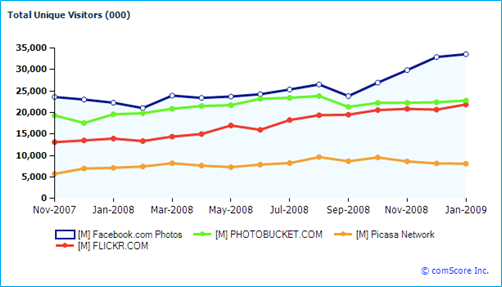

Facebook has massive economies of scope, able to build and sponsor copycat applications that instantly compete with incumbents in the same way that Microsoft client and server applications have a built in advantage – Facebook Photos has more traffic than Flickr and Picasa, popular apps that had first mover advantage. In this case, Facebook’s distribution strategy is even stronger than Microsoft because it does not have to employ a sales force and it’s under no antitrust injunction.

Figure – Facebook photos is # 1 and increasing its lead

For these and other reasons, I expect Facebook’s market power to continue to grow.

Competitive Advantage

| Item | Notes |

| Intellectual Property | All the life conversations of millions of customers which are not portable to an alternative platform. Facebook is also proprietary and closed platform. |

| Brand | World class brand equity |

| Distribution/market presence | Facebook.com one of the most premium sites on the internet |

| Economies of scale | Yes |

| Economies of scope | Yes, more and more kinds of content and applications is transforming this from a communications platform into photo sharing, video calling, etc. |

| Vertical/Horizontal integration | Both |

| Network effects | God, yes! |

| Access to capital | See above |

| Regulation | Minimal privacy regulation. |

In summary, Facebook has a defensible position in the market

Examining economic success/potential for Facebook

- Has the innovator created compelling value proposition? For all relevant parties?

Yes it has vis a vis natural competition like email, IM (Hotmail, Yahoo Messenger)

By creating a powerful and sticky network application, Facebook has made the internet stickier, increasing the intensity of its use. This benefits almost everyone on the telecoms value chain except the last mile (without usage charging). However on balance, even the last mile benefits because Facebook’s horizontal integration strategy allows last mile providers to use its platform as a distribution mechanism for various bundled offerings. This is an exercise of market power.

-

Has innovation led to competitive differentiation?

Vis a vis natural competition like other communications platforms (email, IM, SMS), yes.

-

Does innovator have sustainable competitive advantage

Dues to network effects and a proprietary platform, yes. In addition its benefits many parties in the value chain, allowing it to create friends, not enemies

-

Has innovator gained market power?

Yes. The first app on any platform has to be Facebook either via the web or through a native application. Facebook is also able to extract significant value from content and application distributors on its platform.

Competition

Natural competition

Facebook’s natural competition is any company that provides online communications platforms. In fact it took down (reduced the value of their platforms) several on its way to market power – Hotmail, Gmail, Yahoo and Messenger IM networks etc.

Predators

The nature of Facebook’s network effect leads it into the territory of incumbents that derive value from time spent on a site and any value derived from user generated data. Additionally its economies of scope make any company that offers web applications nervous because of the threat of envelopment – any application mated to Facebook’s distribution engine is instantly successful. The most obvious competitors that fall into this category are Yahoo, Google, Microsoft, Twitter, Zynga etc.

Competing with Facebook

Some of the strategies that have worked with Microsoft are also Facebook’s vulnerabilities. However there is no silver bullet, Apple tried and failed for years and the tech landscape is famously littered with opponents who went into boxing bouts with Microsoft. However to the extent that some strategies will work, I offer the following:

Redefine winning – Facebook has reached critical mass. Therefore winning cannot be judged by beating it at the number’s game. No communication platform offering a similar value proposition will surpass Facebook in # of users for years to come.

Regulation – An argument can be made that Facebook parallels Monopoly era AT&T and should be forced to relinquish some of its control over user conversations using its closed model – which is analogous to AT&T owning the lines and the phones that connect to the lines.

Business model – Facebook’s profit making engine is modest, driven off ads and tolls off its application and content partners. One way to win is to create a network that is able to make more money on fewer customers.

Invent new value proposition protected by IP – Facebook won by offering a compelling and unique take on a communications platform. The next level of this (Telepathy?) will also unseat Facebook when combined with some of this generations insights on creating barriers to entry.

Brand – Apple parlayed a few hits into significant brand equity and has rode that brand equity into even more hits that are gaining traction against Microsoft. People simply trust the brand better. In the same way, a Facebook competitor has to figure out a way to build a better brand. MySpace was essentially out-branded (they were slow to build new approaches to social networking, but by the time they did, the brand erosion was already too much) by Facebook. By building a better brand than Facebook, a competitor will have a better chance. Google+ is not focused on this in any concerted way, trying to differentiate on copyable features and also to coopt the existing customer base of Gmail.

Vertical integration – Facebook has no incentive to vertically integrate beyond the communications platform value chain. This is precisely what a competitor should try and do. Provide the Facebook experience offline in your hand™. Add capabilities like being able to project your friends in 3D (crazy idea) on a handheld device. This kind of competition if successful will tend to drive Facebook off its trajectory to compete.

Platform – Build a better platform. Eventually Win32 was no longer a modern platform for developers. ASP.net saw a lot of competition from PHP. Facebook’s app platform will age, but given its scale, there will be disincentive to change (and perturb the user base). At the same time, you should also see decreasing revenues per supply side user (increasing revenues overall, but spread over more application developers) which will increase the odds that new developers will take a chance on a competing platform that offers more convenience and faster time to market. A competitor can compete by offering a platform that does many things better and faster while offering high customer value.

Distribution

Today, Facebook.com is an efficient distribution mechanism. But what if you made your new social networking application available even more ubiquitously? There are a couple of ways to achieve this:

- Make your product, mywidget, available from the top 100 websites. Anytime a customer opens foo.com, they have access to your interface even without going to mywidget.com

- Embed in other ubiquitous platforms – IE, Firefox and Chrome, Windows, IOS. This makes mywidget available before the first url loads.

- Make your application available offline.

- More…..

Recommendations

Facebook has been able to build modest market power using its current integration strategy while creating few enemies. Its core advantage is to use its network as an application and content platform. Thus I would not recommend major changes to its integration strategy. For example, if Facebook create a vertically integrated device, it will have some cachet to hard core customers but since the iPhone, iPad, Android and Windows Phone all have excellent Facebook capabilities, this will have some salutary effect on revenues but might attract the ire of powerful competitors (Facebook might still win that fight, but nevertheless). More importantly, that will not drive the levers of market power that Facebook already has, which is as a content and application distribution platform.

There are two things I would recommend, both on the margins of strategy:

- I would like to see is a diversification of its revenue base – this is already underway as it proves the power of its distribution network and takes tolls from application and content vendors who build on its platform.

- I would like to see an R&D budget that reflects the threat posed by novel online applications and content that is not currently being offered on Facebook.

Summary

Facebook is/will be formidable because it’s in a winner take most market where it takes a lot of competing to unseat the incumbent after it hits critical mass. I look fwd to seeing if these insight are validated or not.

5 Responses

Really impressed! Everything is very, very clear, open is a description of the problem.It contains the information.I wanted to let you know that I linked to your site with a dofollow links so visitors can come to see your blog.It is all very new to me and this article really opened my eyes,and I guess since I like reading your blog, others will too.You can find the link to your site here:

Zune and iPod: Most people compare the Zune to the Touch, but after seeing how slim and surprisingly small and light it is, I consider it to be a rather unique hybrid that combines qualities of both the Touch and the Nano. It’s very colorful and lovely OLED screen is slightly smaller than the touch screen, but the player itself feels quite a bit smaller and lighter. It weighs about 2/3 as much, and is noticeably smaller in width and height, while being just a hair thicker.

Aw, this was a very nice post. In idea I want to put in writing like this moreover – taking time and actual effort to make an excellent article… but what can I say… I procrastinate alot and in no way appear to get one thing done.

I used to be reading your comments ought to, and i also absolutely trust what Sam said.

Hi there. Today using msn. It is a well written article. I’m going to be likely to bookmark it are available back to find out more of your respective useful info. Wanted post. I’ll certainly return.