Excerpt from a strategy analysis done at the Columbia Business School, months before the reveal of the nascent Apple TV plans and when Steve Jobs was still alive and king of the iKingdom – Oji

Apple CEO Steve Jobs Live at D8 – John Paczkowski – D8 – AllThingsD

Q: Is it time to throw out the interface for TV? Does television need a new human interface?

A: The problem with innovation in the TV industry is the go-to-market strategy. The TV industry has a subsidized model that gives everyone a set top box for free. So no one wants to buy a box. Ask TiVo, ask Roku, ask us… ask Google in a few months. The television industry fundamentally has a subsidized business model that gives everyone a set-top box, and that pretty much undermines innovation in the sector. The only way this is going to change is if you start from scratch, tear up the box, redesign and get it to the consumer in a way that they want to buy it. But right now, there’s no way to do that…. The TV is going to lose until there’s a viable go-to-market strategy. That’s the fundamental problem with the industry. It’s not a problem with the technology, it’s a problem with the go-to-market strategy….I’m sure smarter people than us will figure this out, but that’s why we say Apple TV is a hobby.

Compare the set top box business with the mobile device business (Don’t mobile operators also subsidize devices? What is Steve Jobs saying?). Why has the mobile device business been far more lucrative for device vendors? Where are the barriers to entry in each industry? How were RIM and Apple able to overcome those barriers to entry in the mobile business? Why hasn’t anyone been able to overcome those barriers to entry so far in the pay TV business?

Overview

The mobile device business has a superficial similarity to the set top box business – subsidized devices provided by the operators to provide access to services, but beyond that, the similarities end very quickly. In this brief I will touch on these differences including control of intellectual property and standards, the customer, distribution and how the service is delivered We will also review the nature of the good the customer is consuming and how that is different for mobile devices and the set top box.

Channeling Steve Jobs (What is Steve Jobs really saying)?

Here’s what Jobs is really saying – the cable operators have taken the most critical part of set top box delivered entertainment and both locked up the standards used to provide entertainment but also completely control the distribution of it by subsidizing the device to near zero. This control of the standards and the distribution through both subsidy and organizational tactics like coming to customer’s homes to “activate” ports, hands Cable operators (COs) tremendous leverage which is very difficult for CE manufacturers to defeat. Let’s parse Jobs in parts:

The problem with innovation in the TV industry is the go-to-market strategy.

“It’s incredibly tough to enter this market when the cable operators have a stranglehold on it”

The TV industry has a subsidized model that gives everyone a set top box for free. So no one wants to buy a box.

“First you usually cannot compete with free. But we can do it sometimes (see iPhone vs. free features phones; we won) if there is a level playing field for innovation. But in this market there isn’t, so we cannot deliver price adjusted value significantly over and above the cable operator provided set top boxes because they also control the technical standards that deliver content. Cable has taught customer to not value the box, but that’s the most critical thing. Through their partners, they also control distribution of the technology.”

Ask TiVo, ask Roku, ask us… ask Google in a few months. The television industry fundamentally has a subsidized business model that gives everyone a set-top box, and that pretty much undermines innovation in the sector. The only way this is going to change is if you start from scratch, tear up the box, redesign

“We need a level playing field. As long as they have controlling access to premium episodic content and control the standards for getting access to it, and also give the box away for free, we’re screwed. If you can open the standards and move away from the mess of CO issued cable cards, we will see some innovation across the board in form factors.”

and get it to the consumer in a way that they want to buy it.

“You should see innovations in form factor (why is the cable box separate from the TV when Moore’s law marches on?) You should see new models of distribution like pre-paid, etc.”

But right now, there’s no way to do that…. The TV is going to lose until there’s a viable go-to-market strategy.

“We lack leverage to bring cool things to TV on the device side (aside from the TV itself). TV will not see innovation until we fix that. User generated content on the internet is not enough otherwise we would do a YouTube for iTunes.”

That’s the fundamental problem with the industry. It’s not a problem with the technology, it’s a problem with the go-to-market strategy….I’m sure smarter people than us will figure this out, but that’s why we say Apple TV is a hobby.

“Good luck if you’re Tivo or Google TV. It sucks to be you right now but you might actually show the way and then our iDevice will not be far behind. Cue [Evil Laughter].”

Analysis

To provide answers to the rest of the questions, we will ask specific questions of both the mobile and cable ecosystems, answer them and then summarize the results:

- What is the value chain for MOs and Cos

- How open is the platform?

- Who owns the customer?

- Who makes the device?

- Who controls distribution?

- How is service delivered to the device?

- Who controls the standards for the device’s operation?

- What services are delivered to the device?

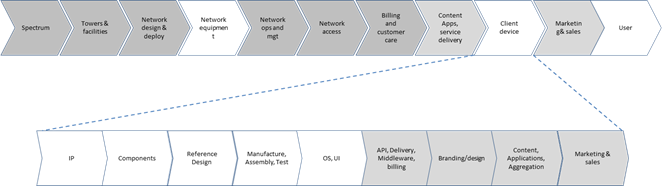

What is the value chain (and which part is controlled by Operators?)

Cable operators value chain (Darkness denotes the degree of control)

Mobile operators value chain (Darkness denotes the degree of control)

In both pictures note the amount of control exerted over the device sub chain. Control is much higher in the COs value chain than in the Mobile Operators (MOs).

It’s important to note that while mobile devices are essentially vertically integrated i.e. the phone contains presentation (display), baseband (wireless chipset) and computation on board (APU). The entertainment device (which includes the set top box market) market is disaggregated i.e. the cable companies prefer to separate the presentation of content (TVs) from the baseband and computation (set top box) and then dominate the latter and cede the former to CE companies (they prefer to exert control through lobbying and legislation along with the content companies).

The only equivalence in the MO value chain for what obtains in cable set top box market is if the Mobile Operators took the wireless chipset out of all phones and controlled IP, applications, distribution and branding of that component. In addition, that component would be a black box which enclosed the SIM inside the device and you would need to call them each time you want to use a new phone to ask for their permission and bond the two together. And this device would be distributed for near free, almost destroying the chances that anyone would make an alternative that has a chance of catching on (the COs controls a lot of the IP and can catch up quickly with any new innovations because they also control distribution.)

How open is the platform?

| Mobile | Set top box | Note | |

| Demand side user | Open | Open | |

| Supply side user | Mixed – mostly open | Closed | |

| Platform provider | Open | Closed | |

| Platform sponsor | Mixed – mostly closed | Closed |

The mobile is more open than cable empirically with a wider array of supply side complements and providers, some of which distribute independently and some through the MO. Some sub platforms within this ecosystem are closed (iphone), but by and large, it is open to entry by those who can pay modest licensing fees. Mobile device makers and MOs share the platform provider role in most markets, tilting one way or another depending on regulation and standards adopted. For instance the US is less open than Europe. In mobile, platform sponsors are closed with a few companies exerting control (winners are Qualcomm. Nokia etc.) This openness is the reason that mobile device makers have been able to be successful; more successful than the set top box device manufacturers

In contrast the cable operators essentially ensure a closed platform except to the demand side users. They actively stifle any complements (on-demand services, guide provision) and platform providers (Tivo, Movie Beam, and Microsoft). In addition they control the standards and IP of key technologies (Cable Labs, legislation and regulation)

Who owns the customer?

| Set top box | Mobile |

| The cable company (or satellite company) | The mobile company in some markets. The device make in some others. Power tilts to the MO. |

The customer, in both cases, are owned by the Operators. However the degree is different. MOs live in a generally more competitive market (nationwide coverage, converging technologies like 4G) and innovations like LNP drive down the switching costs of leaving one operator to another. They also face more complements to their services. This aligns incentives to be less limiting of customers which in turn allows supply side users and platform providers to gain leverage. In contrast the COs essentially operate regional monopolies which creates different incentives. The customer is completely deeply dependent on the CO for the content service including the “free” set top box.

Who makes the device?

| Set top box | Mobile |

| Several companies, but some sell to the cable companies on contract and some sell directly the to the customers without | Several companies. Most sell into the mobile operators. Same companies sell into the retail channel directly but I reduced volume (in developing countries) |

While there is a robust ecosystem of device makers in the MO world, there is very little in the CO world. The CO outsources the device manufacturing to companies like Scientific Altanta/Cisco but in reality they function as contract manufacturing for the CO.

Who controls distribution?

| Set top box | Mobile |

|

|

Distribution is almost completely controlled by COs in the set top box market. While there is still significant control in the Mobile market MOs, this is somewhat diluted by the deployment of strong mobile brands (Nokia circa 2006, Apple circa 2010) and regulation (Europe vs. US) which allow retail distribution.

How is service delivered to the device?

| Set top box | Mobile |

|

|

Set top boxes communicate with complicated technology (Cablecard, tru2way) at CableCo’s head end which authorizes individual channels to see if a customer should have access to it. The video stream is then unencrypted at the customer device for the consumer. The CEA has been pushing for these technologies to be streamlined and simplified so that any CE device can participate in the ecosystem. However the cable companies clearly see a benefit in not only controlling this technology but also delaying its availability and broad deployment. One way it does this is by insisting that CE devices do not come with “security” on board but need assistance from a Cable Company to “add” to the device. In other words, the set top box market exists because of the Cable companies insistence that it does so that they can continue to separate entertainment display from authorization to the content.

Services delivered by the devices

| Set top box | Mobile | ||

Subsidized set top box

|

Unsubsidized set top box

|

Carrier bought mobile

|

Retail mobile phone

|

In other words, MOs use holdbacks to maintain control of the set top device. They can continue to do this because of their control over critical IP. It’s useful here to also think of the nature of what is being offered.

COs offer media/video content from content providers. This has high intrinsic value, is rare, has no easy substitutes and they have interests aligned with the value chain.

MOs offer mobile “airtime” and access to mobile data and applications. In essence they let you you’re your mom. This has high intrinsic value but is not rare (wifi, skype), has easy substitutes (email, skype, land line) and interests in the value chain are more chaotic.

This reality accrues to the ability of COs to maintain control over the set top box given their current arrangement.

Who controls the standards?

Cable companies control the key standards through cable labs (Cable Card version x, Tru2way, etc). They have also proved adroit at championing legislation in their favor. They outsource mundane problems like compression and signaling efficiency to their partners.

Barriers to entry in mobile

- Price adjusted value – entrants have to deliver high value/dollar to compete

- Create standards, compliant device – Able to deliver standards compliant device and pay related licensing fees.

- Build or buy middle ware layer – Devices have to go beyond communications and support applications.

- Distribution – Ensure access to carriers to support your middleware, distribute your hardware alongside a rate plan.

RIM & Apple overcoming barriers

- RIM focused on making a specialized device for email communications and to provide this value in compelling way that would reduce churn and drive up ARPU for operators. They also catered to the concerns of the MOs about the utilization of scarce spectrum.

- Apple traded on a great CE device track record and brand with a specific value proposition for its partner – (a) Drive increased customer volume (b) reduce churn by increasing satisfaction. In return it asked for and received distribution control.

Barriers to entry in set top

- Price adjusted value – entrants have to deliver high value/dollar to compete because the COs offer cable set top boxes for nominal low prices.

- Distribution – entrants have to find a distribution model better than the COs which essentially bundles devices with the service in all cases.

- Intellectual property & Standards control – entrants have to be able to exert some influence over relevant standards. This includes making existing standards irrelevant if possible.

- Differentiation – differentiation of form (consumers are tired of more boxes), differentiation of user interface (see Tivo UI), differentiation of content or content presentation. Without this cable will be good enough for many millions of customers.

- Access to premium and episodic content through content providers – entrant must secure access to compelling content. Ideally they should also provide access to content already available through the cable set top box.

- Preserving incentives for the ecosystem – need to design a device or service that provide sufficient incentives for content owners and advertisers

-

Critical mass – enough of an audience that the paymaster to the content owners will pay attention (and work to shift things in your favor)

Why hasn’t anyone been able to overcome those barriers to entry so far in the pay TV business?

Mostly because of # 5 & 6 above. A few companies have come close and are still trying – Netflix, Apple, Google (Google seems to be in the worst position because it’s making no attempts to secure premium content.)

Here a quick look at ongoing and recently defunct (MediaFlo) efforts:

| Barriers | Tivo | Netflix | Set top box | Apple | |

| Tivo | Netflix applications | CableCo box | Apple TV | Google TV | |

| Intellectual property – IP | In presentation layer, blocked by Cable | In presentation layer, attempting to bypass existing standards | Standards | None, attempting to bypass existing standards | None, attempting to bypass existing standards |

| Intellectual property – Content | Low. Access to web content | Medium (movies), little TV | High | Low, with iTunes | Lowest |

| Brand | High | High | High recognition, bad customer affinity | High | Medium |

| Distribution/Market presence | Low | High | High | Low | Very Low |

| Economies of scale | No | Yes | Yes | Yes – potential | No |

| Economies of scope | Yes | Yes | Yes | Yes | Yes |

| Vertical/Horizontal | Vertical, going horizontal | Horizontal | Vertical | Vertical | Vertical |

| Network effects | Low | Yes | Yes | Yes | No |

| Access to capital | Low | Medium | High | High | High |

| Regulation | Low influence relative to competition | Insider, but low relative to competition. Better position than Tivo | Incumbent |

Insider, but low influence relative to competition | Insider but perceived as active threat to competition |

By this analysis, Netflix has had an admirable run at the problem but with clearly limited results, primarily because content owners are still very much aligned with the Cable Companies as premium distribution and are risk averse in terms of upsetting those interests and relationships. In addition Netflix is seeing movement towards fixed bandwidth plans which will likely stifle its growth. However these barriers are not insurmountable, but clearly execution is critical. Apple’s rumored TV is intriguing although it will run into 2 considerations: (a) Price and (b) Sales cycles – most people replace their TVs every 5-7 years and differentiation is key to accelerating that.