Excerpt from a strategy analysis done at the Columbia Business School

Summary

On the surface, Akamai and Bittorrent have similar solutions to similar sounding problems, to whit: How do you move content from content owner’s originating servers to requesting consumers without the delays associated with the general internet. This is a serious problem for (a) companies whose livelihood and tactical advantage depends on a promptly and timely serving this request (as quickly or faster than the competition) and (b) companies for which this content is jitter sensitive, like long running video.

The solution of course for both companies is essentially to locate the content as close to the requestors as possible. However the devil is in the details: and it’s in the details that the solutions of these companies differ. This difference and some externalities contribute to a diverging strategy and diverging results in the market.

Comparing the strategies of Akamai and Bit Torrent

Akamai’s strategy summary

Akamai’s since its inception has focused on delivering on the promise of creating a virtual and proprietary routing overlay over the public internet and using this content network to speed response times for its clients across a wide variety of content. In particular Akamai’s technology covers the network layer with special hooks into the session and application layer (HTTP, File txfer, Application APIs) which allows it to do well with interactive content as well as long form jitter sensitive content like streaming video. It can do this primarily because its proprietary edge network servers are full application processing unit which can function at any of the OSI layers.

Akamai has finessed the dance of its collaborator’s interests, getting near free colocation from partners that it benefits (ISPs and their POPs) and more expensive presence in the core at NSPs which do not benefit from its service.

By offering a core CDN service, tools to bring content to this service more easily and expanding into interactive content (PHP and ASP web pages, videos, etc.) and dynamic applications, Akamai has ridden the innovation curve expertly while extracting additional revenue streams. It did this by leveraging its full OSI stack capable infrastructure to essentially do more (economies of scope) with incremental R&D spend.

Notable features of Akamai’s strategy:

- It scales to relevant content types easily, http, embedded files, video, interactive web pages, and now applications.

- It recognized and extracted rent from customers for using its overlay for the content types. It particularly has well itemized and proven side effect benefits like origin website cost savings, bandwidth savings, scalability and improved resilience to denial of service attacks.

- It offered a full service offering to make onboarding to its CDN an easier investment (lower maintenance and staffing costs).

- Strategy is explicitly cognizant of key collaborators and their interests. In particular it co-sold its services with partners like IBM.

- Flexibility – by using edge servers with full OS and hardware complement, Akamai can adapt easily which helps with economies of scope and scale for its bigger capital expense.

Bittorrent’s strategy summary

Bittorrent essentially wandered into becoming a for-profit concern in 2004, after starting out as a science project for Bram Cohen and released in 2001. For years its predominant use was for illegal file sharing even though it clearly had many more potential uses for content distribution. Its key competitive advantage over CDNs was its ability to accelerate content to the edges by utilizing the resources of the edge itself; the already paid for computer and bandwidth of the end user. As such Bittorrent could deliver content efficiently without deploying much capital, provided it could convince ordinary users to participate in its network.

However before realizing this commercial value proposition, Bittorrent had several hurdles to cross:

- Does not do as well for interactive content while Akamai does; really more proven for downloads vs. streaming i.e. real-time content.

- Fewer latency guarantees than Bittorrent because significant flows can still traverse the general internet.

- It had a tainted brand, associated with piracy or at the very least, free riding.

-

Key network level collaborators had their doubts about Bittorrent and some actively worked against it, including trying regulatory chokeholds:

- ISPs did not enjoy that it created far more upload traffic flows than their networks were designed for and keep pushing for regulatory approval to ‘manage’ Bittorrent flows.

- Customers did not enjoy the swamping of a PC’s network ports which sometimes slowed the other critical network tasks (browsing, gaming, etc.) to a crawl in the customer’s entire home.

- Backbone providers were mildly concerned about the level of TCP and UDP flows across the internet backbone attributable to Bittorrent.

- ISPs did not enjoy that it created far more upload traffic flows than their networks were designed for and keep pushing for regulatory approval to ‘manage’ Bittorrent flows.

- End user perception of cloud of litigation persists over the use of Bittorrent.

- While Bittorrent is the ultimate egalitarian solution – you have to share to get – it’s not always clear how participants in the network are benefitting. Put another way, there are some incentives to be selfish (reduce upload speed, stop seeding once download is complete) which retard network effects.

Importantly, Bittorrent appears not to have firm control of key levers required for strategic success:

- Slow in solving negative network externalities to key partners like ISPs and customers by publishing a selfish protocol (that crowds out other protocols); even with its claims of being more ‘polite’.

-

Bittorrent Inc. enables the platform but does not own the platform components. I.e. diffuse sense of the company as platform provider.

- The Bittorrent protocol is open source allowing many providers to supply the market.

- Customers contact the publisher of the application not Bittorrent Inc.

- Bittorrent Inc.’s own torrent client is not the most popular in use.

- The Bittorrent protocol is open source allowing many providers to supply the market.

- No control or formal partnerships over platform component suppliers like Microsoft, Apple (OSes), Dell, HP (PC hardware), etc.

- Slow to adapt the function of the network quickly as CDNs have done from downloading, to streaming, to application delivery. It’s still stuck in variety providing, and slowly moving into matching with its latest Chrysalis Beta.

- End user individual behavior might affect the reliability and quality of the Bittorrent network which casts in doubt the ability of Bittorrent to offer firm guarantees to commercial customers.

Analysis

Innovation and Economic success

| Akamai | Bittorrent | |

| Has innovator created a compelling value proposition? | Yes, content delivery networks are essential to the business of high value and volume websites | Yes, provides a useful subset of CDN functionality |

| For which relevant parties? | ISPs End customers Content sites |

Content sites Customers |

| Has innovation led to competitive differentiation? | Yes, quickly adapting their network function to deliver content and then move into application delivery. Also extracting rent by creating management tools | Maintaining significant competitive differentiation for downloading files but not much else (has a small streaming media offering). |

| Does innovator have a sustainable competitive advantage? | Due to innovation and function adaptation, yes | Neutral to positive because of network effects |

| Has innovator gained market power? | Yes | No |

Sources of competitive advantage

| Akamai | Bittorrent | |||

| Intellectual property | Neutral | Yes, strong IP which it controls | ||

| Brand | Yes | Negative | ||

| Distribution | Yes, by itself and via collaborators | Neutral | ||

| Economies of scale | Yes, uses its deployed capital better each round | Yes, built into the protocol | ||

| Economies of scope | Yes, increased functional value over time with low R&D investment | Unknown | ||

| Vertical/Horizontal integration | Slightly | Slightly, with its device licensing | ||

| Network Effects | Yes | Yes | ||

| Access to capital | ||||

| Regulation | ||||

Value chain

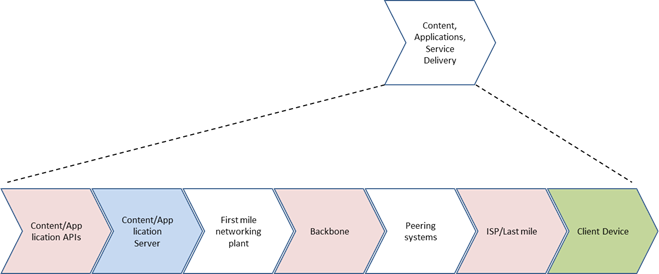

Akamai’s presence in the value chain is denoted by pink, while Bittorrent is green. Blue is dual presence.

As you can see, Akamai is better integrated into the value chain and in such a way as to gain more influence along the path of content with respect to Bittorrent.

Conclusion

Bittorrent has not succeeded vis a vis Akamai yet for some of the following key reasons (among other smaller ones):

- Has not sufficiently bought the support of key collaborators like ISPs and NSPs for which it introduces negative network externalities

- Has not expanded its functional scope rapidly beyond accelerated download services. For instance even its streaming services are advertised as working atop CDN services, probably because it cannot offer a guarantee firm enough to displace CDN offerings. This is an additional expense that might not be critical to a content company. Its ability to service interactive web pages and application delivery is unproven in the market place.

- Its open source approach to its intellectual property is not delivering any discernable strategic advantage because it is not a 1:1 substitute for CDN services and might be retarding its ability to take control of its branding. It’s also retarding its ability to charge a good price for its innovation. It’s unclear if this can be reversed.

- Current user perception of network effects is shallow although this is almost made up for by the protocol itself. Yet, this perception is key to higher willingness to pay for current and future services of Bittorrent.

- Some key component suppliers are inadvertent (Windows, MacOS, Dell, HP) and therefore not properly harnessed to deliver integrative value.

One Response